Plug Power Faces Multiple Downgrades After Disappointing Q3 Results

Plug Power (NASDAQ: PLUG), a leading manufacturer of hydrogen fuel cells, saw its stock price plunge by more than 34% on Thursday after reporting a wider-than-expected loss and lower-than-expected revenue for the third quarter of 2023. The company also issued a going concern warning, indicating that it may not be able to continue as a going concern without raising additional capital. Several analysts reacted to the earnings report by downgrading the stock and slashing their price targets, citing concerns about the company’s profitability, cash flow, and hydrogen supply issues.

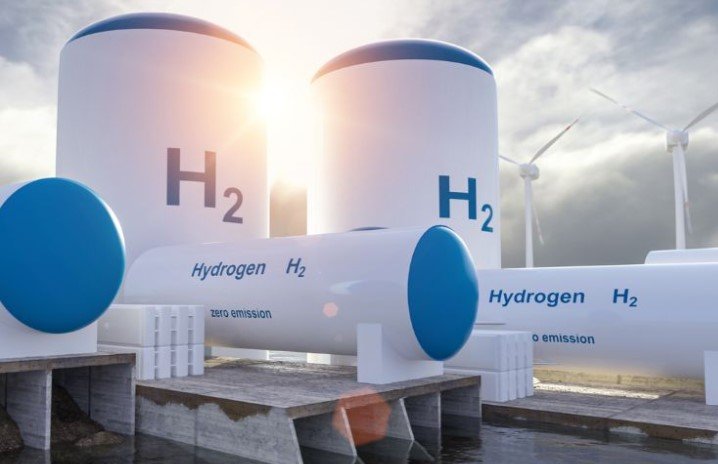

Hydrogen Supply Disruption Hits Revenue and Margins

Plug Power’s revenue for the third quarter increased by 5.3% year-over-year to $198.7 million, but the analysts’ consensus estimate of $220 million was missed. The company attributed the revenue shortfall to “unprecedented supply challenges” in the hydrogen network in North America, which affected its sales of fuel cell systems, hydrogen, and services. The company expects the hydrogen supply situation to improve by the end of the year as its Georgia and Tennessee facilities resume full production capacity.

The hydrogen supply disruption also had a negative impact on the company’s gross margin, which was -69% for the quarter, compared to -8% in the same period last year. The company said that it incurred higher costs for hydrogen, transportation, and logistics, as well as lower utilization of its assets and personnel. The company also recorded a $100 million impairment charge related to its investment in Hyzon Motors, a hydrogen truck maker that went public via a SPAC merger earlier this year.

Losses Widen and Cash Burn Increases

Plug Power’s net loss for the third quarter widened to $0.47 per share, from $0.30 per share in the same quarter last year, and was significantly higher than the analysts’ consensus estimate of a loss of $0.30 per share. The company’s operating loss also increased to $221.4 million from $79.8 million in the prior-year quarter.

The company’s cash flow from operations was negative $164.6 million, compared to negative $36.9 million in the third quarter of 2022. The company’s free cash flow was negative $215.9 million, compared to negative $85.8 million in the same period last year. The company ended the quarter with $1.1 billion in cash and equivalents, down from $1.8 billion at the end of the second quarter.

The company said that it expects to generate positive operating cash flow in the fourth quarter of 2023 and positive free cash flow in 2024. However, the company also warned that it may need to raise additional capital to fund its growth plans and meet its debt obligations. The company said that it is exploring various financing options, including corporate debt, asset-backed financing, and the U.S. Department of Energy’s loan program.

Analysts Turn Bearish on Plug Power Stock

Following the earnings report, several analysts downgraded Plug Power stock and lowered their price targets, expressing doubts about its growth prospects, profitability, and valuation. Here are some of the analysts’ reactions:

- JPMorgan analyst Paul Coster downgraded Plug Power stock to neutral from overweight and cut his price target to $6 from $10. The analyst said that the company’s Q3 results reflected multiple headwinds, including hydrogen supply issues, operational challenges, and capital market uncertainty. The analyst said that he would remain on the sidelines until the company showed signs of improving its profitability and balance sheet.

- RBC Capital analyst Chris Dendrinos downgraded Plug Power stock to Sector Perform from Outperform and reduced his price target to $5 from $12. The analyst said that the company’s Q3 results were disappointing and that the hydrogen supply constraints are affecting all segments of the company’s business. The analyst also said that the company’s cash flow outlook is uncertain and that the stock is trading at a premium valuation compared to its peers.

- Oppenheimer analyst Colin Rusch downgraded Plug Power stock to Perform from Outperform and removed his price target of $21. The analyst said that the company’s Q3 results were below expectations and that the company faces several challenges, including hydrogen availability, equipment sell-through, and funding requirements. The analyst said that he would wait for more clarity on the company’s balance sheet and growth trajectory before becoming more constructive on the stock.

- Susquehanna analyst Biju Perincheril downgraded Plug Power stock to neutral from positive and slashed his price target to $4.50 from $9. The analyst said that the company’s Q3 results were weak and that the company’s near-term outlook is uncertain. The analyst said that the company’s hydrogen supply issues, cash flow pressures, and funding needs are likely to weigh on the stock’s performance in the coming quarters.

Plug Power stock closed at $3.73 on Thursday, down 34.4% for the day and 75.6% for the year. The stock has a market capitalization of $2.9 billion and a price-to-sales ratio of 14.6.